Auto Insurance in and around Massillon

Massillon's first choice car insurance is right here

Take a drive, safely

Would you like to create a personalized auto quote?

Here When The Unexpected Arrives

When life has you out on the road, things don't always go smoothly. Because hailstorms or theft can happen to anyone, anytime, you need car insurance coverage you can trust.

Massillon's first choice car insurance is right here

Take a drive, safely

Auto Coverage Options To Fit Your Needs

Even better—reliable coverage from State Farm is possible for a wide array of vehicles, from sedans to smart cars to scooters to motorcycles.

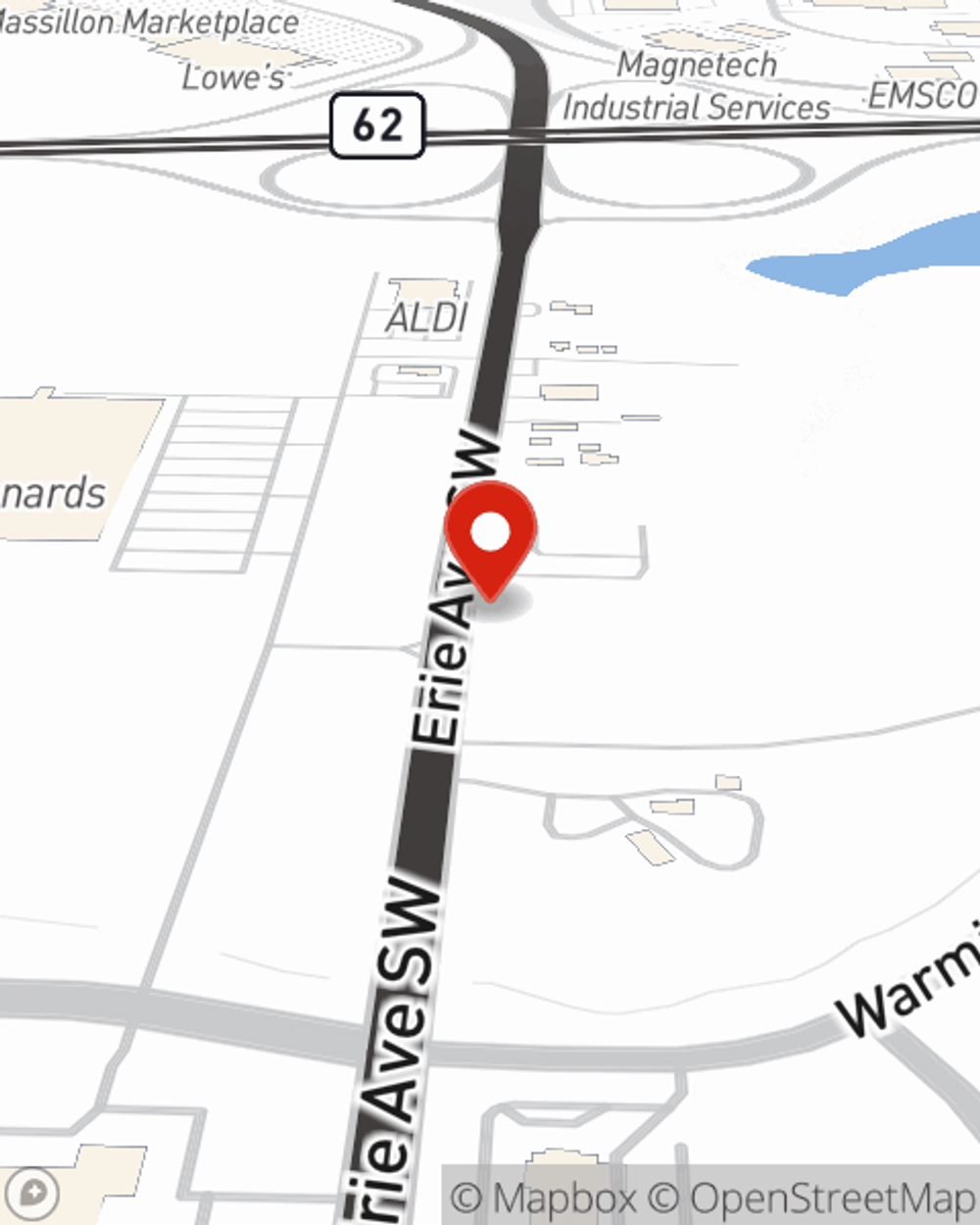

So, get State Farm coverage today and drive with confidence, Massillon. Simply call or email agent Robert Garner's office to get started.

Have More Questions About Auto Insurance?

Call Robert at (330) 834-3276 or visit our FAQ page.

Simple Insights®

The real costs of a non-moving or moving violation

The real costs of a non-moving or moving violation

Critical driving errors may end up draining your bank account and your free time. States vary in how they punish those mistakes and missteps, and it's helpful to know what's at stake.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Robert Garner

State Farm® Insurance AgentSimple Insights®

The real costs of a non-moving or moving violation

The real costs of a non-moving or moving violation

Critical driving errors may end up draining your bank account and your free time. States vary in how they punish those mistakes and missteps, and it's helpful to know what's at stake.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.